Our Approach.

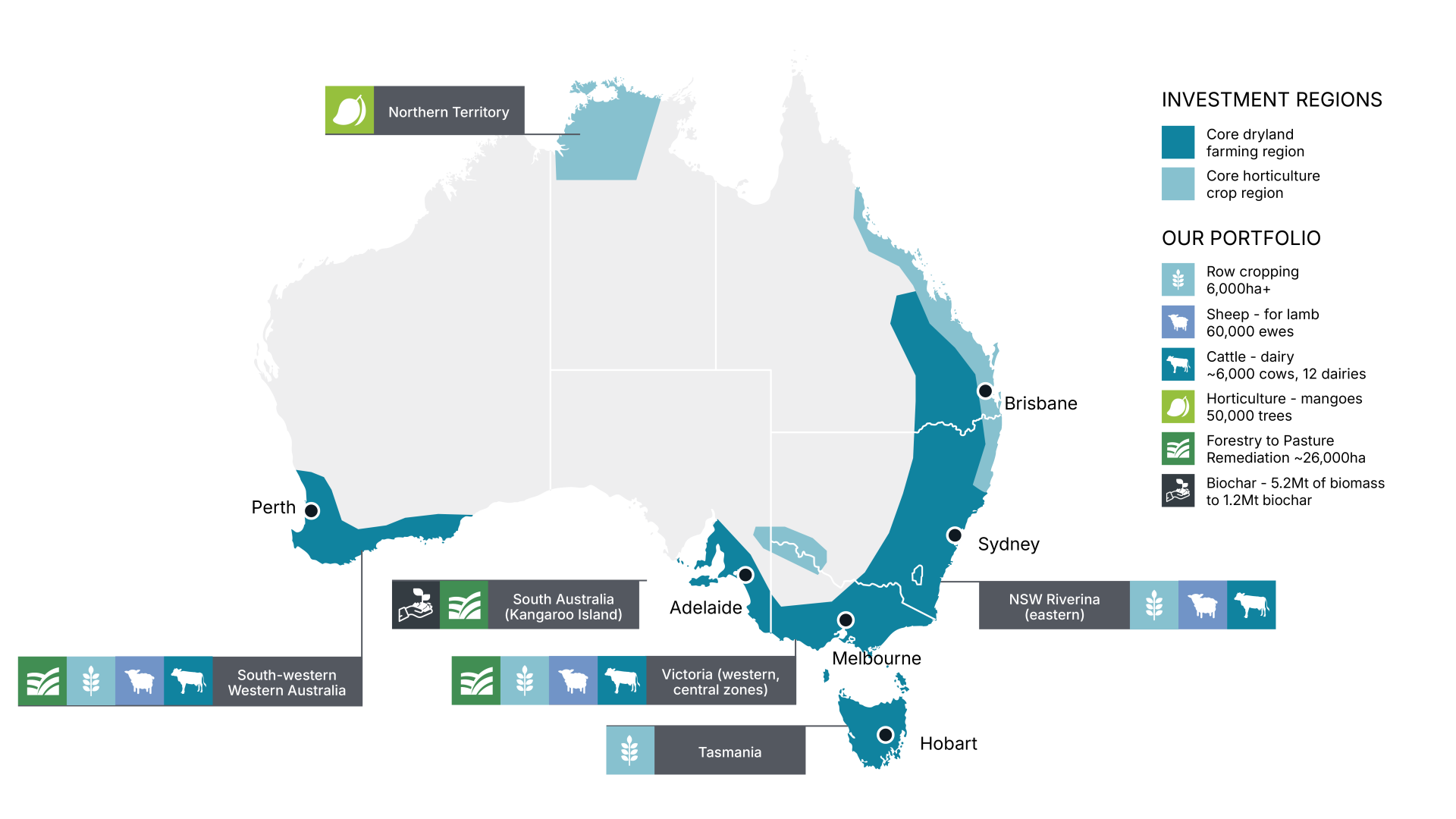

AAGIM focusses on agricultural investments in Australia’s core dryland and horticultural zones. Farmland in three regions offer more reliable seasons, in turn supporting higher reliability of cash returns and stronger capital growth rates. Within this framework, we focus on three investment options.

Transformational.

Moderate risk, active management, Net IRR 12-15%+

Acquisition and transformation of actively managed assets. High impact investing, particularly in “special situations”. Leveraging scale, long-term experience and market power. Improved returns from integrating agri-industrial or waste to energy opportunities.

Active Mainstream.

Lower risk, carefully managed mainstream assets,

Net IRR 7-12%

Actively operated assets in beef, sheep, dairy and row crops offering investment diversification and inflation protection. Options for lease and lease-back investments or share-farm type kickers to improve returns.

Active Permanent.

Higher risk, active management, Net IRR 14%+

Opportunistic acquisition of permanent crop assets, generating returns through improved operations, further acquisitions and intensification.

Our Operations.

AAGIM focusses on high rainfall, high reliability, farmland in Australia’s core dryland and horticulture farming regions.